The new year (or any fresh start) is the perfect time to set financial resolutions. But let’s be honest: most resolutions fail by February.

So how do you set money goals that last, and—more importantly—stick to them?

In this article, you’ll learn how to create financial resolutions that are realistic, motivating, and built for long-term success.

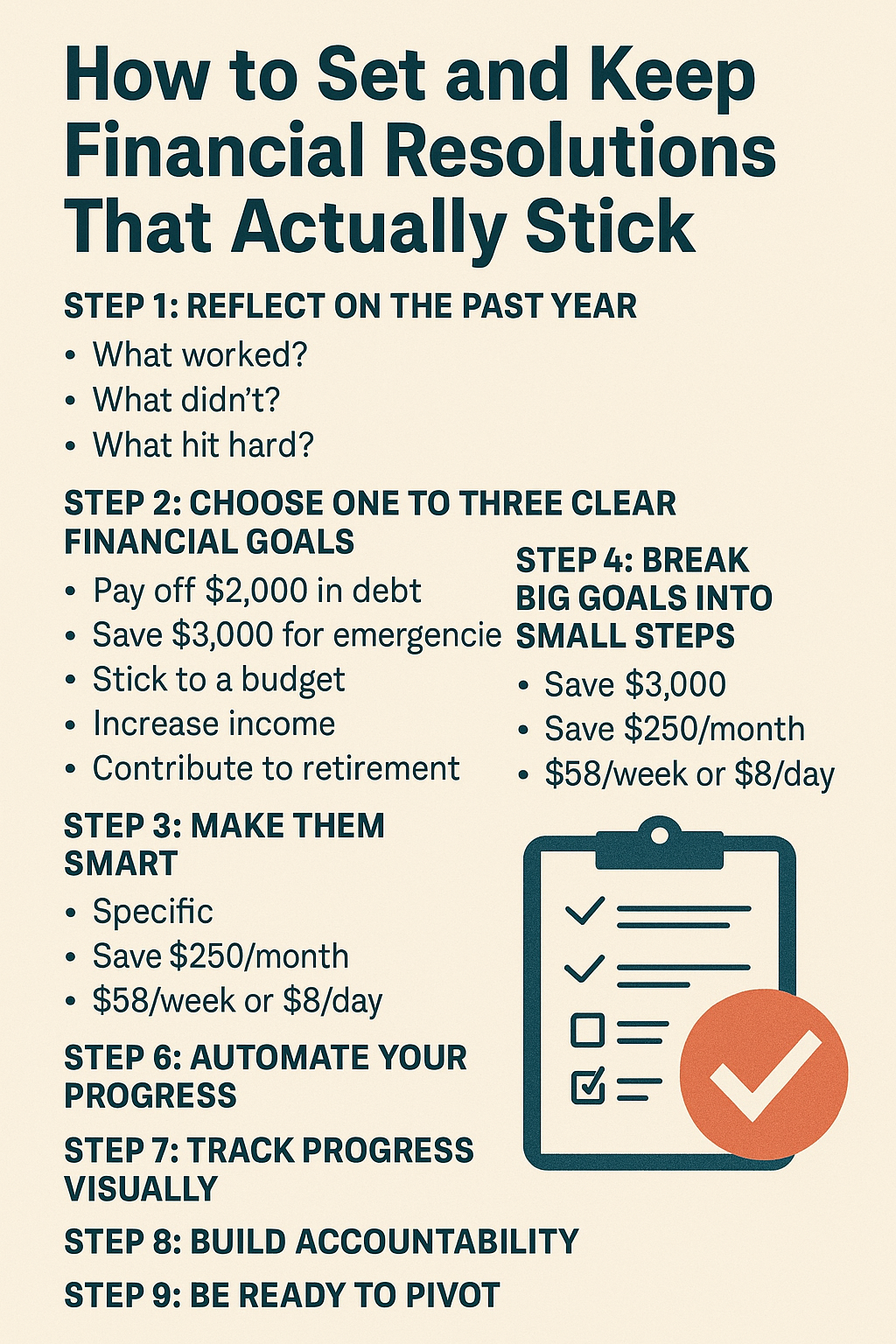

Step 1: Reflect on the Past Year

Before looking forward, take a moment to look back. Ask yourself:

- What worked financially last year?

- What didn’t work?

- What unexpected expenses hit hard?

- What goals did I start but not finish?

Use your answers to guide better decisions going forward.

Step 2: Choose One to Three Clear Financial Goals

Too many goals = overwhelm.

Pick 1–3 specific goals that matter most right now:

- Pay off $2,000 in credit card debt

- Save $3,000 for an emergency fund

- Stick to a monthly budget all year

- Increase income with a side hustle

- Contribute $100/month to a retirement account

Prioritize based on urgency and emotional impact.

Step 3: Make Them SMART

Turn vague hopes into actionable goals with the SMART formula:

- Specific – What exactly are you trying to achieve?

- Measurable – How will you track your progress?

- Achievable – Is this realistic given your income/lifestyle?

- Relevant – Does this align with your life and values?

- Time-bound – What’s your deadline?

✅ Instead of: “Save money.”

✅ Try: “Save $1,200 by December by putting $100/month in a savings account.”

Step 4: Break Big Goals Into Small Steps

Big goals can feel overwhelming. Make them bite-sized:

Goal: Save $3,000

- Save $250/month

- Or $58/week

- Or $8/day

Use auto-transfers or a visual savings tracker to make progress visible.

Step 5: Create a Monthly Financial Routine

Consistency beats intensity.

Build a simple monthly routine:

- Review your budget

- Track income and expenses

- Check progress on goals

- Adjust as needed

- Celebrate small wins

Put a monthly reminder on your calendar to make it a habit.

Step 6: Automate Your Progress

Automation removes willpower from the equation. Set up:

- Auto-savings transfers

- Automatic debt payments

- Scheduled investments

- Bill autopay to avoid late fees

When you automate success, you’re more likely to stay on track.

Step 7: Track Progress Visually

Humans are visual creatures. Use:

- A printable tracker on your fridge

- A progress bar in your budgeting app

- A notebook or spreadsheet

- A goal chart with milestones

Seeing your wins fuels momentum.

Step 8: Build Accountability

Tell a friend, partner, or online group your goals. Check in monthly.

You’re more likely to follow through if:

- Someone is rooting for you

- You’re reporting progress

- You’re celebrating wins with others

Accountability = motivation.

Step 9: Be Ready to Pivot

Life happens. You might:

- Lose income

- Have surprise expenses

- Fall behind on your plan

That’s okay. Pause, adjust, and keep going.

Flexibility keeps you in the game when perfection isn’t possible.

Step 10: Celebrate Every Win (Even the Small Ones)

Paid off one credit card?

Saved your first $100?

Stuck to your grocery budget for a month?

Celebrate it! Rewarding progress keeps your brain engaged and builds motivation.

Ideas:

- A favorite treat

- A relaxing activity

- A journal entry or shoutout to yourself

Final Thoughts: Resolutions That Last Are Built on Habits

Financial resolutions aren’t about perfection—they’re about direction.

Set small, specific goals. Track your progress. Adjust when needed. And most importantly, be patient with yourself.

This is your year to take charge of your money—not with pressure, but with purpose.