Being in debt can feel overwhelming—but the right strategy can help you take back control of your finances. One of the most effective and beginner-friendly ways to eliminate debt is the snowball method.

In this article, you’ll learn what the snowball method is, how it works, why it’s so effective, and step-by-step instructions to start using it today.

What Is the Snowball Method?

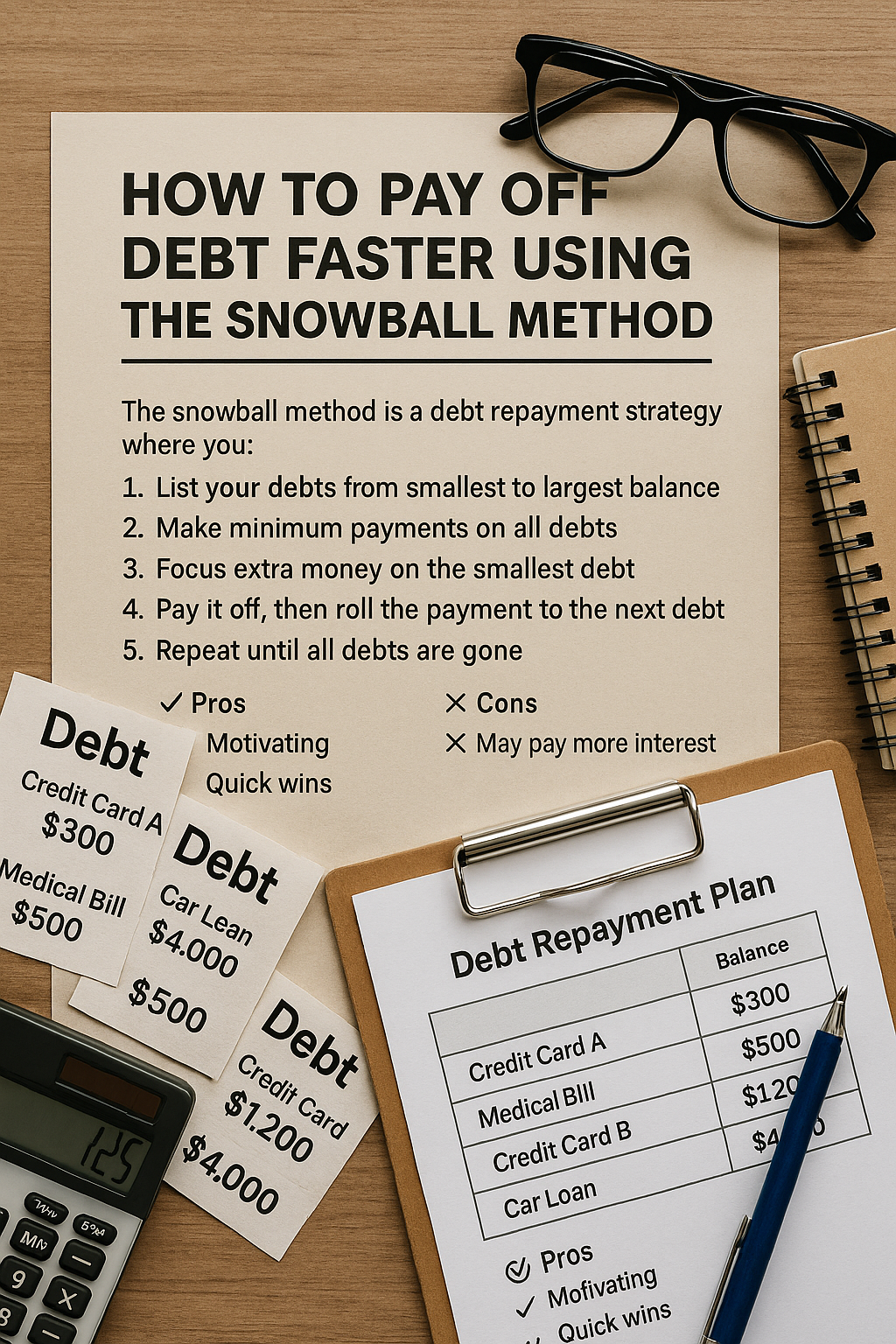

The snowball method is a debt repayment strategy where you:

- List your debts from smallest to largest balance (regardless of interest rate)

- Make minimum payments on all debts

- Focus all extra money on the smallest debt

- Once that debt is paid off, roll its payment into the next one

- Repeat until all debts are gone

Just like a snowball rolling downhill, your payments get bigger as each debt is cleared—building momentum and motivation.

Why It Works (Even Better Than Math Sometimes)

You might wonder: Why not pay the highest interest debt first?

While that’s mathematically efficient (called the avalanche method), studies show that people are more likely to succeed with the snowball method because:

- You see quick wins

- Small victories boost motivation

- You stay engaged and committed

- It feels good to eliminate full balances one by one

Money is emotional, and the snowball method respects that.

Step-by-Step: How to Use the Snowball Method

1. List All Your Debts

Include:

- Credit cards

- Personal loans

- Student loans

- Car loans

- Medical debt

Record for each:

- Balance owed

- Minimum monthly payment

- Interest rate (for reference)

2. Order Them from Smallest to Largest Balance

Ignore interest rates for now. Focus on balance size only.

Example:

| Debt Type | Balance | Minimum Payment |

|---|---|---|

| Credit Card A | $300 | $25 |

| Medical Bill | $500 | $50 |

| Credit Card B | $1,200 | $75 |

| Car Loan | $4,000 | $150 |

3. Make Minimum Payments on All Debts

Never skip a payment. Continue to pay the minimum due on each debt every month to avoid late fees and credit damage.

4. Focus Extra Money on the Smallest Debt

Let’s say you have an extra $100/month. Pay the $25 minimum on Credit Card A, then add the $100 extra. That’s $125/month going toward your smallest debt.

This clears the first debt quickly—giving you a confidence boost.

5. Roll That Payment Into the Next Debt

Once Credit Card A is paid off:

- Take that $125

- Add it to the $50 minimum on the Medical Bill

- Now you’re paying $175/month toward the next debt

Repeat this process. With each win, your “snowball” of money grows.

6. Stay Consistent

The key is consistency. Set reminders, automate payments if possible, and track your progress monthly. Watching your balances shrink feels great.

Pros and Cons of the Snowball Method

✅ Pros:

- Motivating and emotionally satisfying

- Simple to follow

- Quick wins build momentum

- Ideal for beginners or those feeling overwhelmed

❌ Cons:

- May cost more in interest over time (vs. avalanche method)

- Doesn’t prioritize interest rate savings

- Less effective if your largest debt has a very high interest rate

When Should You Use the Snowball Method?

This method is perfect if:

- You’ve struggled to stay consistent with debt payoff

- You’re overwhelmed by multiple balances

- You need quick wins to stay motivated

- You’re emotionally stressed about your debt

If you’re very numbers-driven and can stick to a strict plan without motivation issues, consider also exploring the avalanche method.

Tools to Help You

Use apps or spreadsheets to automate and track your progress:

- Undebt.it – Free tool to build snowball or avalanche plans

- Tally – Automates credit card debt payments

- YNAB or Mint – For budgeting alongside debt repayment

- Printable snowball charts – Visually track progress at home

Final Thoughts: Small Steps Lead to Big Victories

The snowball method proves that progress is better than perfection. You don’t need to be a financial expert—just start small, stay consistent, and keep going.

Debt freedom might feel far away now, but with each paid-off balance, you’ll gain more energy, more clarity, and more control over your financial life.