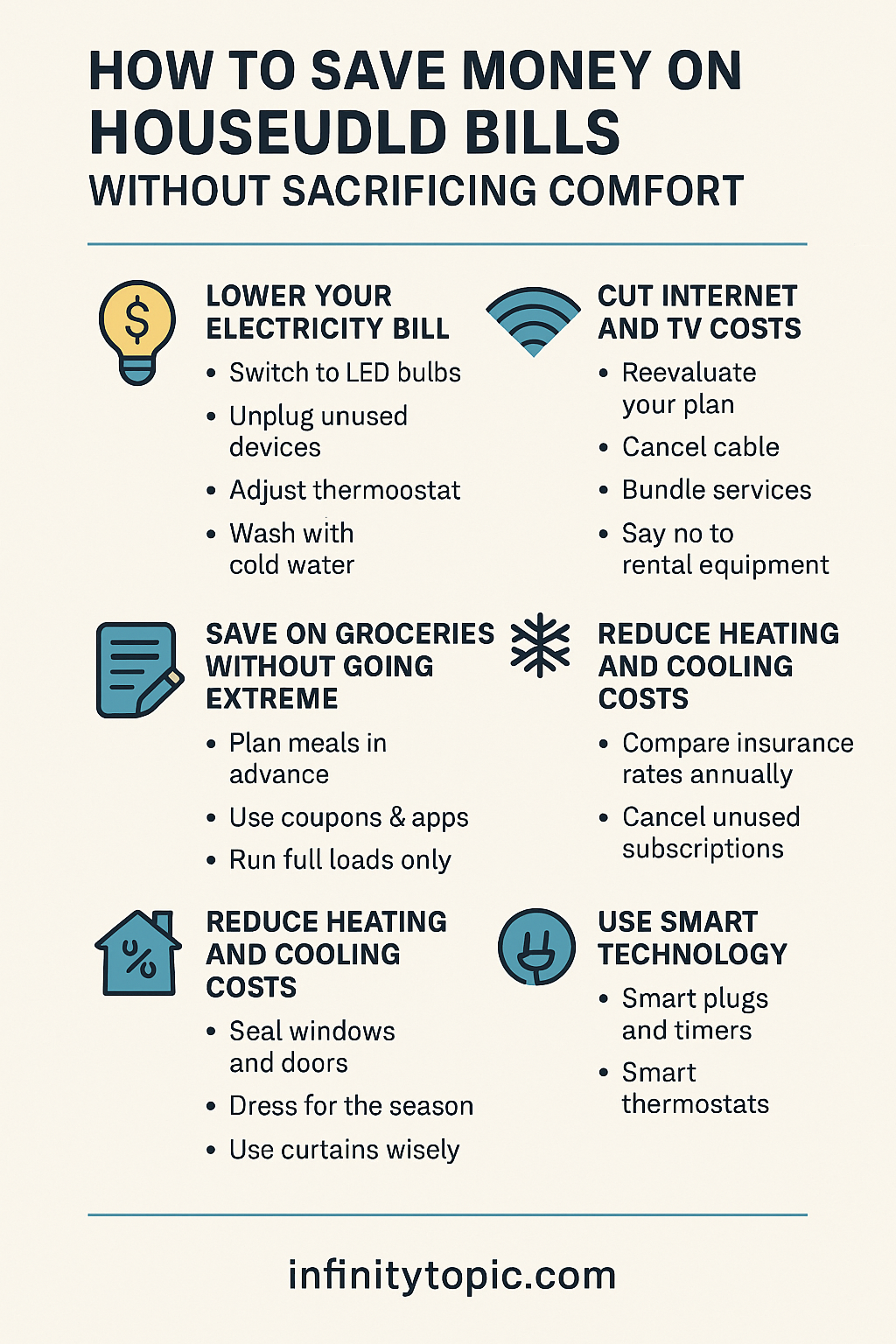

Want to lower your monthly expenses without living like a minimalist monk? You’re not alone. Household bills—like electricity, water, internet, and groceries—can take a huge chunk of your income. But with a few smart strategies, you can cut costs without giving up convenience or comfort.

In this article, we’ll explore practical, beginner-friendly tips to reduce your household bills and keep more money in your pocket.

1. Lower Your Electricity Bill

Electricity is often one of the biggest monthly expenses. Try these simple changes:

💡 Switch to LED Bulbs

LEDs use up to 80% less energy than incandescent bulbs and last years longer.

🔌 Unplug Unused Devices

Devices still draw power when plugged in—even if turned off. Use power strips to easily disconnect multiple electronics.

🌡️ Adjust Your Thermostat

Set your thermostat to 68°F (20°C) in winter and 78°F (25°C) in summer to save on heating and cooling. Use a smart thermostat to automate savings.

🧺 Wash with Cold Water

Most of your laundry doesn’t need hot water. Cold cycles use less energy and are gentler on your clothes.

2. Reduce Your Water Bill

🚿 Take Shorter Showers

Try limiting showers to 5–7 minutes. Every minute saved = less water and heating cost.

🚽 Fix Leaks Immediately

A dripping faucet or leaking toilet can waste hundreds of gallons per month.

🧼 Run Full Loads Only

Wait until the dishwasher or washing machine is full before running a cycle.

💧Install Low-Flow Fixtures

These are inexpensive and easy to install—and they reduce water usage by 30% or more.

3. Cut Internet and TV Costs

📶 Reevaluate Your Plan

Are you paying for internet speed you don’t need? Downgrade if you’re only using it for browsing, streaming, or Zoom calls.

📺 Cancel Cable

Streaming services like Netflix, Hulu, or YouTube TV are cheaper than traditional cable. Choose 1 or 2, and rotate them monthly to avoid subscriptions piling up.

☎️ Bundle Services

Some providers offer discounts for bundling internet, phone, and streaming.

🚫 Say No to Rental Equipment

Many ISPs charge $10–$15/month for a modem/router. Buying your own can save money long term.

4. Save on Groceries Without Going Extreme

📝 Plan Meals in Advance

Make a meal plan and shopping list each week. Stick to it. Avoid impulse buys.

🏷️ Use Coupons and Apps

Apps like Ibotta, Fetch, and store loyalty programs give you cashback or discounts.

🍽️ Buy in Bulk—Smartly

Non-perishables like rice, pasta, and canned goods are great to stock up when on sale.

🚫 Avoid Pre-Packaged Items

Pre-cut fruit or ready meals cost more. Go for whole ingredients when possible.

5. Reduce Heating and Cooling Costs

🪟 Seal Windows and Doors

Drafts waste energy. Use weather stripping or window insulation film.

🧥 Dress for the Season

Wear warm clothes indoors in winter instead of cranking the heat. Use fans instead of AC in mild weather.

🪞Use Curtains Wisely

Open curtains during the day to let sunlight in (winter), and close them to block heat (summer).

6. Save on Insurance and Subscriptions

🔄 Compare Insurance Rates Annually

Auto, home, and renter’s insurance rates vary widely. Shopping around yearly can save hundreds.

🧾 Cancel Unused Subscriptions

Use apps like Truebill or Rocket Money to identify and cancel recurring charges you’ve forgotten about.

7. Use Smart Technology

🕒 Smart Plugs and Timers

Automatically turn off lights and electronics when not in use.

🧠 Smart Thermostats

They learn your schedule and adjust temperature settings to optimize energy use.

Final Thoughts: Spend Smarter, Not Harder

You don’t have to sacrifice comfort to save money. Small, consistent changes can lead to big savings over time. Track your monthly bills and challenge yourself to lower them just a little each month.

It’s not about being cheap—it’s about being intentional. And the money you save? That’s power in your hands.