Talking about money with the people we care about can be uncomfortable. But learning how to set clear financial boundaries is essential for protecting your budget, your goals, and your peace of mind.

In this article, you’ll learn how to say “no” with confidence, avoid guilt, and maintain healthy relationships—all while staying true to your financial priorities.

What Are Financial Boundaries?

Financial boundaries are the limits you set around how you give, lend, spend, and talk about money—especially with others.

They help you:

- Avoid overspending out of pressure

- Say no without guilt

- Stick to your financial goals

- Protect your mental and emotional energy

- Maintain respectful relationships

Without boundaries, money can become a source of stress, resentment, and even conflict.

Why It’s Hard to Set Boundaries With People We Love

You might feel:

- Afraid of disappointing others

- Guilty for having more (or less) than them

- Pressured to help or impress

- Worried about damaging the relationship

But the truth is: healthy boundaries lead to healthier relationships—because they’re built on honesty and respect, not obligation or secrecy.

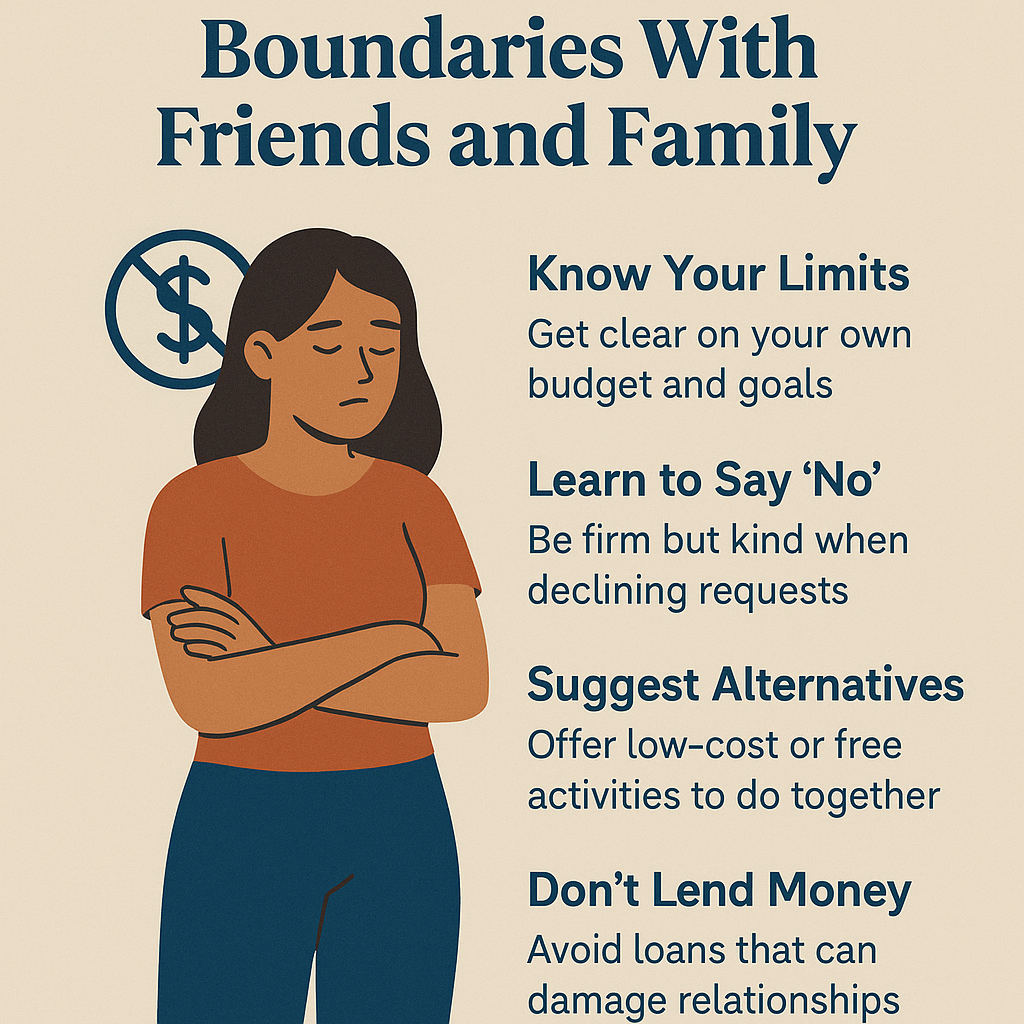

Step 1: Know Your Own Financial Limits

Before you can set boundaries, get clear on:

- Your monthly budget

- Your savings goals

- Your ability (or inability) to give, lend, or participate in events

You can’t protect what you’re not clear about. Knowing your numbers gives you confidence to say no.

Step 2: Identify Your Most Common Challenges

Ask yourself:

- Do I feel obligated to lend money I can’t afford to lose?

- Do I overspend to “keep up” with friends?

- Do I avoid talking about money with my partner?

- Do family members assume I’ll cover costs without asking?

Recognizing the pressure points helps you prepare your response in advance.

Step 3: Practice Saying “No” Without Over-Explaining

You don’t owe anyone a long explanation.

Examples of firm but kind responses:

- “That’s not in my budget right now.”

- “I can’t afford to lend money, but I hope things improve for you.”

- “I’d love to join, but I’m cutting back on spending this month.”

- “Let’s find something that fits both of our budgets.”

You can say no with compassion—but no is still no.

Step 4: Suggest Alternatives When You Can

Can’t afford a $200 weekend getaway? Suggest a local hike or coffee hangout.

Can’t buy a pricey gift? Offer to cook dinner or write a heartfelt note.

Showing you care doesn’t have to cost money—it just requires creativity and communication.

Step 5: Don’t Lend What You Can’t Afford to Lose

If you choose to lend money, treat it as a gift you might not get back. Otherwise, it can strain the relationship.

Alternatives:

- Offer help in non-financial ways

- Share resources or information

- Connect them with professionals or support services

Protecting your financial health isn’t selfish—it’s responsible.

Step 6: Be Honest With Your Partner

Money is a major source of tension in relationships. Clear communication is key.

Talk about:

- Budgeting styles

- Joint vs. individual accounts

- Spending limits

- Financial goals

Set boundaries around shared purchases, debt, and financial responsibilities.

Step 7: Don’t Apologize for Prioritizing Your Future

You’re allowed to:

- Skip expensive weddings or trips

- Say no to splitting bills evenly if you can’t afford it

- Focus on saving, paying off debt, or building wealth

- Protect your peace and your wallet

Your future matters. Your mental health matters. Your goals matter.

Step 8: Be Consistent

If you say yes one time and no the next, people may get confused or push back.

Set clear expectations early and stick to them. Over time, people will respect your stance—and some may even follow your lead.

Final Thoughts: Boundaries Create Freedom, Not Distance

Setting financial boundaries doesn’t mean you care less. It means you’re choosing respect over resentment, and clarity over conflict.

It might feel uncomfortable at first—but the long-term benefits are worth it.

Protect your money. Protect your energy. And know that saying “no” is sometimes the most generous thing you can do—for yourself and for the people you love.