“Financial freedom” is one of the most common goals people talk about—but what does it really mean? And more importantly, how can you achieve it in your own life?

In this article, we’ll explore what financial freedom looks like, why it matters, and the exact steps you can take—starting today—to move toward a life where money no longer controls you.

What Is Financial Freedom?

Financial freedom means having enough money and financial stability to make choices based on what you want—not what you can afford.

It means:

- You’re not living paycheck to paycheck

- You’re free from high-interest debt

- You can cover emergencies without stress

- You’re saving and investing for the future

- You have options and control over your time

It’s not about being “rich”—it’s about being in control.

Levels of Financial Freedom

Financial freedom isn’t all-or-nothing. It happens in stages:

- Stability – You can pay your bills on time and have a small emergency fund.

- Security – You have 3–6 months of expenses saved and no toxic debt.

- Flexibility – You can travel, work less, or change careers without financial panic.

- Independence – You no longer need to work for money (your income comes from investments or passive sources).

- Abundance – You have more than enough to live your ideal lifestyle and give generously.

Why Financial Freedom Matters

Without it, life feels like survival mode.

With it, you get:

- Peace of mind

- Choices and flexibility

- Freedom to pursue passions

- Less stress and healthier relationships

- Time—your most valuable asset

Money isn’t everything. But when handled well, it creates space for what really is.

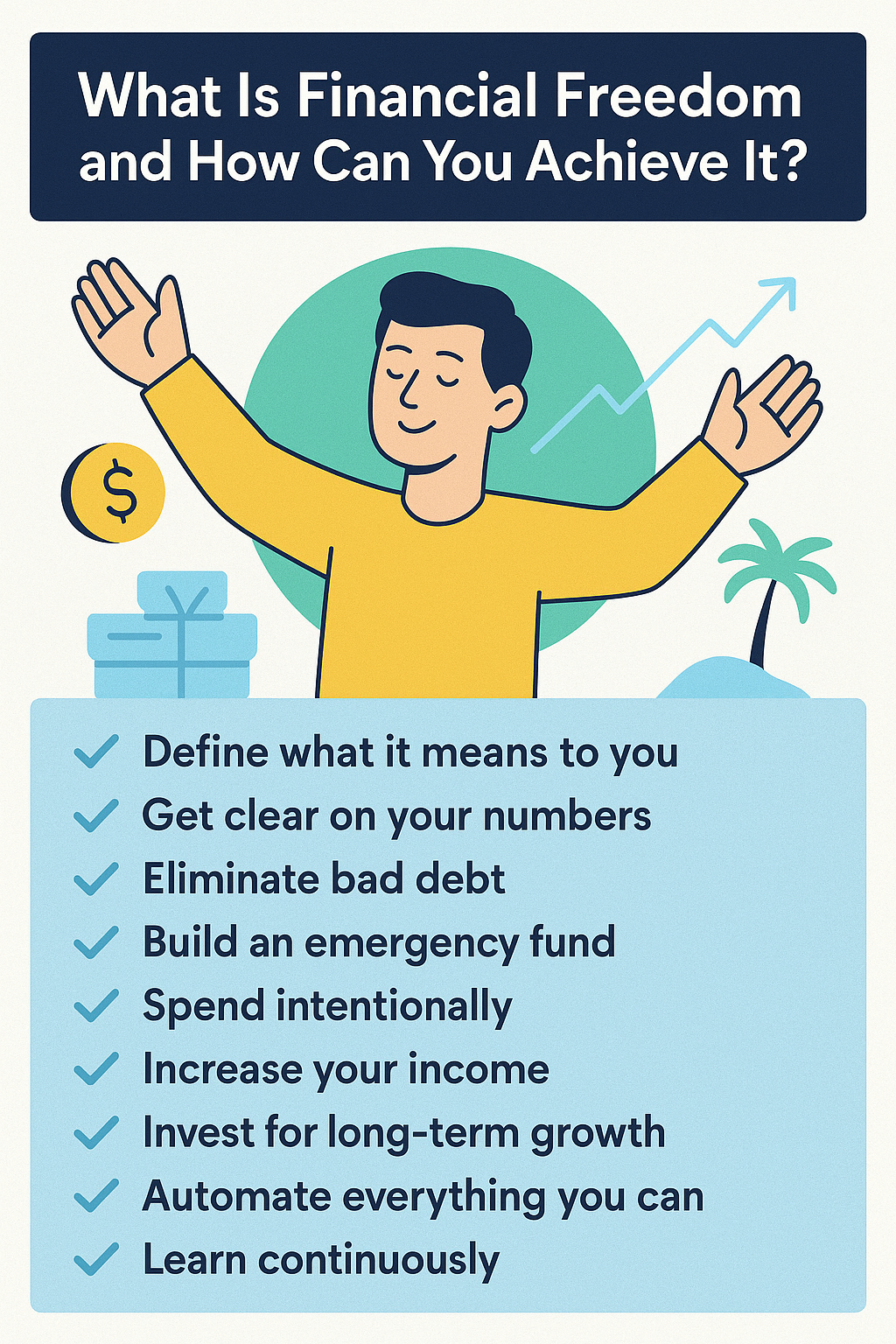

How to Achieve Financial Freedom (Step by Step)

✅ Step 1: Define What Financial Freedom Means to You

Everyone’s vision is different. Ask yourself:

- What would life look like if money weren’t a barrier?

- How much would you need monthly to feel free?

- What do you want more time or flexibility for?

Write it down. This is your personal freedom number.

✅ Step 2: Get Clear on Your Numbers

Track your:

- Income

- Fixed and variable expenses

- Debts

- Net worth

- Savings rate

Clarity is the first step to control.

✅ Step 3: Eliminate Bad Debt

Debt keeps you stuck. Create a plan to pay off:

- Credit cards

- Personal loans

- High-interest store financing

Use the avalanche (interest-based) or snowball (balance-based) method—whichever you’ll stick with.

✅ Step 4: Build an Emergency Fund

Aim for:

- $1,000 to start

- 3–6 months of expenses as you grow

Keep it in a separate high-yield savings account. This prevents setbacks from becoming financial disasters.

✅ Step 5: Spend Intentionally

Financially free people don’t deprive themselves—they spend with purpose.

- Avoid impulse purchases

- Create and follow a realistic budget

- Use cash or debit when necessary

- Align spending with your values and goals

Every dollar you don’t waste is a dollar toward your freedom.

✅ Step 6: Increase Your Income

You can only cut so much—but you can always earn more.

Ideas:

- Ask for a raise or promotion

- Start a side hustle

- Sell unused items

- Freelance or teach online

- Monetize a skill or hobby

Use extra income to fuel debt payoff and investing.

✅ Step 7: Invest for Long-Term Growth

Start as early as possible—even with small amounts.

- Use tax-advantaged accounts like Roth IRA, 401(k)

- Invest in index funds and ETFs

- Use robo-advisors if you’re unsure where to start

Let compound interest do the heavy lifting over time.

✅ Step 8: Automate Everything You Can

- Bill payments

- Savings transfers

- Retirement contributions

This removes willpower from the equation and builds consistency.

✅ Step 9: Learn Continuously

Financially free people read, listen, and learn constantly.

Recommended books:

- The Simple Path to Wealth by JL Collins

- Your Money or Your Life by Vicki Robin

- The Psychology of Money by Morgan Housel

Knowledge = power = freedom.

Final Thoughts: Freedom Isn’t a Dream—It’s a Plan

Financial freedom isn’t about perfection or being born rich. It’s about making smart, consistent choices—one day, one paycheck, one decision at a time.

You don’t need to be there yet. You just need to start walking in that direction.

Because every dollar you save, every debt you pay off, and every moment you learn brings you closer to a life where you own your time—and your money works for you.